- Best expense tracking software for home based business how to#

- Best expense tracking software for home based business manual#

The IRS and CRA are wary of people claiming personal activities as business expenses. On the back of the receipt, record who attended and the purpose of the meal or outing. Conducting a business meeting in a café or restaurant is a great option, just be sure to document it well. There are five types of receipts to pay special attention to: For US store owners, the IRS doesn’t require you to keep receipts for expenses under $75, but it’s a good habit nonetheless. This process can be simple and old school (bring on the Filofax), or you can use a service like Shoeboxed. It’s a crucial step that lets you monitor the growth of your business, build financial statements, keep track of deductible expenses, prepare tax returns, and legitimize your filings.įrom the start, establish an accounting system for organizing receipts and other important records. The foundation of solid business bookkeeping is effective and accurate expense tracking. Check with the individual bank for which documents to bring to the appointment. To open a business bank account, you’ll need a business name, and you might have to be registered with your state or province. Most business checking accounts have higher fees than personal banking, so pay close attention to what you’ll owe. Shop around for business accounts and compare fee structures. Corporations and LLCs are required to use a separate credit card to avoid commingling personal and business assets.īefore you talk to a bank about opening an account, do your homework. Credit is important for securing funding in the future. Next, you’ll want to consider a business credit card to start building credit. A good rule of thumb is to put 25% of your income aside, though more conservative estimates for high earners might be closer to one third. For instance, set up a savings account and squirrel away a percentage of each payment as your self-employed tax withholding. Start by opening up a business checking account, followed by any savings accounts that will help you organize funds and plan for taxes. Sole proprietors don’t legally need a separate account, but it’s definitely recommended. Note that LLCs (See our state specific guides for California LLC, Texas LLC and Florida LLC ), partnerships, and corporations are legally required to have a separate bank account for business. And if you want funding down the line, from creditors or investors, strong business financial records can increase the likelihood of approvals. It also protects your personal assets in the unfortunate case of bankruptcy, lawsuits, or audits. Having a separate bank account keeps records distinct and will make life easier come tax time.

Best expense tracking software for home based business how to#

Learn how to manage your books Accounting basics for small businessesĪfter you’ve legally registered and begun the process to start a business, you’ll need somewhere to stash your business income. Luckily, it’s possible to learn how to manage your own books and there are a few notable benefits to tackling it yourself.

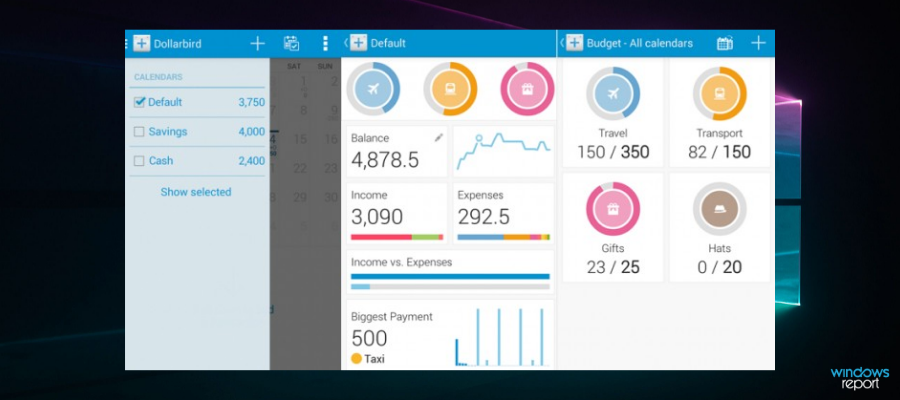

All rights reserved.Bookkeeping is something that you either have to learn or outsource when you’re running a business. © 2009-2022 Chrome River Technologies, Inc. With powerful spend analytics at their fingertips, executives can transform oceans of business expense data and invoice data points into visually-compelling and actionable reports. It gives the CFO, the Finance Team, and Travel Managers complete visibility into global spend, expense policy compliance, all the way to the true cost of sales. The expense reporting app you choose has to work as beautifully as your business travelers' favorite music app. Chrome River EXPENSE is cloud based: acting as a simple mobile app one minute and picking up right where you left off on your desktop or laptop the next.īut modern expense management software goes much further. After all, your expense reporting software has to be easy-to-use and comprehensive.

Best expense tracking software for home based business manual#

Your phone camera gives you the freedom to Snap and Send receipts when and where they happen with smart OCR to virtually eliminate manual data entry. How does a simple expense report let business flow? When that expense report gives business travelers and expense approvers the freedom to work anywhere on any device with one web app that never needs updating or downloading. From Expense Reports to Expense Management

0 kommentar(er)

0 kommentar(er)